Table of contents:

- Who can take advantage of the thermo-modernization relief?

- What expenses are deductible?

- How to deduct the thermo-modernization relief?

- More information

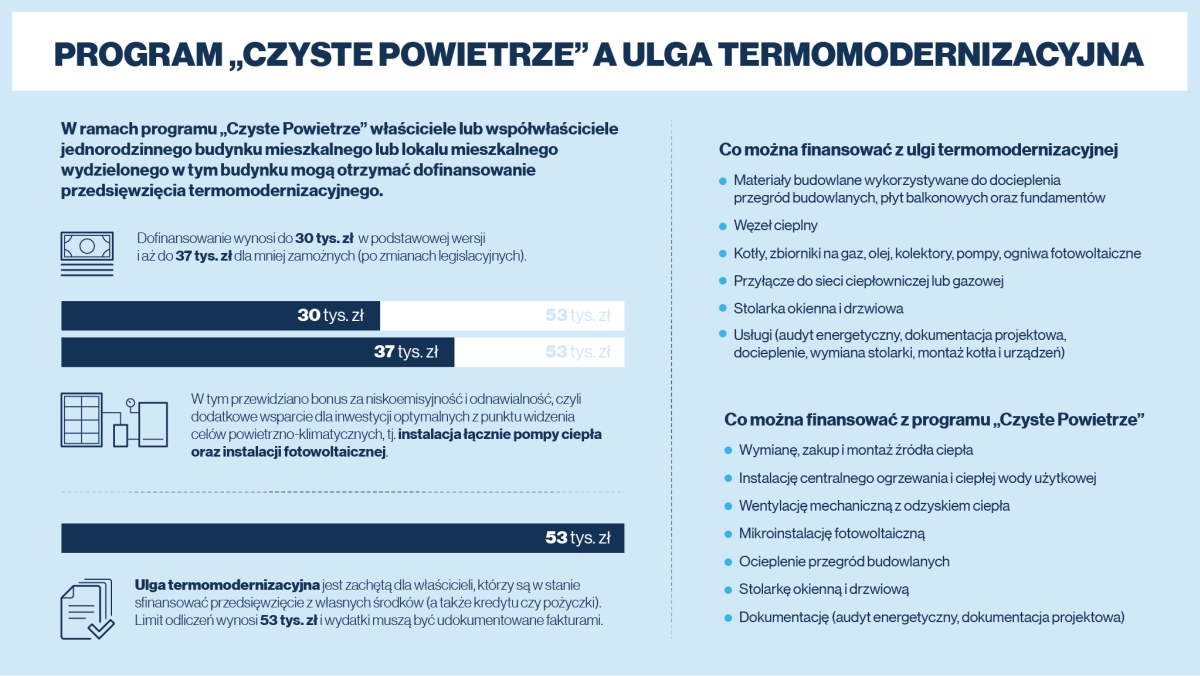

Last week, we briefly discussed the government’s Clean Air program and discussed the issues related to obtaining funding for the replacement of windows under it. Today, however, we will show you another way to reduce the costs of such a renovation, namely thermomodernization relief .

Who can take advantage of the thermo-modernization relief?

The thermomodernization relief is deducted from the tax base. It can be used by owners or co-owners of single-family houses , including those in semi-detached, terraced houses or groups, who pay income tax. It should be emphasized that the relief cannot be used in the case of buildings currently under construction .

The condition for granting the discount is to bear the costs related to the thermal modernization works of the renovated building. In order to document these costs, appropriate VAT invoices must be presented. The thermomodernization project should be completed within the maximum time of three consecutive years from the end of the fiscal year in which the first expenditure was incurred.

The thermo-modernization relief can be combined with a subsidy from the Clean Air program.

What expenses are deductible?

Expenses related to thermal modernization projects in single-family houses are deductible. Such projects are all activities that lead to the reduction of the demand for energy supplied for the purposes of heating and heating utility water and heating buildings. In addition, these are all works that lead to the improvement of thermal insulation properties of buildings , as well as complete or partial replacement of energy sources with renewable sources.

As the replacement of windows with energy-saving ones with a low heat transfer coefficient is an expense improving the thermal characteristics of the building, it is definitely eligible for a discount. This also applies to doors, gates and other building materials necessary to insulate building partitions. All types of expenses qualifying for the thermo-modernization relief are listed in the appendix to the ordinance of the Minister of Investment and Development of December 21, 2018. on determining the list of types of building materials, devices and services related to the implementation of thermal modernization projects (Journal of Laws, item 2489).

Expenses financed by the National Fund for Environmental Protection and Water Management, provincial funds or reimbursed in any form, as well as tax deductible costs, are not deductible.

How to deduct the thermo-modernization relief?

The deduction is made in the tax return for the year in which the expense was incurred. If the thermal modernization project is not implemented within three years, the granted relief will have to be returned, adding it to the income (revenue) for the tax year in which the three-year period has expired.

The maximum amount of the thermo-modernization relief may not exceed PLN 53,000 for all completed thermo-modernization projects. This limit is not related to the building, but to the taxpayer. This means that it applies to all real estate owned or jointly owned by the claimant . However, married people use separate limits. In such a case, each of them may deduct PLN 53 thousand from the tax.

More information

Additional information on the thermo-modernization relief can be found on the website of the government’s Clean Air program .

The legal basis for the thermomodernization relief is:

- Article 26h of the Act of July 26, 1991 on personal income tax,

- article 11 of the Act of November 9, 2018 amending the act on personal income tax and the act on flat-rate income tax on certain revenues earned by natural persons